Overview: Dynamic Yield and CredSpark as Conversion Rate Optimization Category solutions.

Dynamic Yield focuses primarily on increasing user engagement and sales, with a strong suite of analytics and customization tools appealing to retail and internet industries. In contrast, CredSpark excels in lead generation and content management, favoring enterprises in the publishing sector looking for robust engagement solutions. While Dynamic Yield supports a broad market with multiple support options, CredSpark caters to niche markets with a straightforward 24/7 support system, reflecting their emphasis on efficiency and content-driven strategies.

Dynamic Yield: Dynamic-yield's Experience OS delivers personalized, optimized, and synchronized digital experiences. Personalization and experimentation are pioneered by Dynamic Yield by Mastercard.

CredSpark: CredSpark helps organizations engage audiences, generate zero-party data, and boost revenue with interactive content. Innovative content experiences drive measurable business growth.

Dynamic Yield and CredSpark: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Dynamic Yield facilitates engagement management, merchandising, and segmentation, positioning itself as a versatile tool for enhancing customer interactions. read more →

CredSpark excels in engagement management and lead generation, making it particularly effective for enterprises focusing on content-driven engagement. read more →

Business Goals

Dynamic Yield focuses on increasing sales, enhancing customer relationships, and improving ROI, which aligns well with retail and large enterprise objectives. read more →

CredSpark aims to improve ROI and enhance customer relationships, ideal for businesses seeking thought leadership and brand engagement. read more →

Core Features

Dynamic Yield offers extensive analytics, integrations, and custom reporting which cater to comprehensive marketing strategies in large markets. read more →

CredSpark features robust analytics and custom reporting, emphasizing data-driven content management for effective audience engagement. read more →

Vendor Support

Dynamic Yield provides extensive support options, including 24/7, chat, and phone, meeting diverse operational needs. read more →

CredSpark offers 24/7 support, aligning with businesses prioritizing continuous availability for optimal content management. read more →

Segments and Industries

Dynamic Yield is popular with mid-market and enterprise customers, especially in retail and sports industries. read more →

CredSpark predominantly serves enterprises within the publishing sector, focusing on specialized engagement strategies. read more →

Operational Alignment

Dynamic Yield fits well into operations of large-scale companies thanks to its robust features and extensive industry applications. read more →

CredSpark aligns with enterprises looking for straightforward solutions, particularly in industries driven by content and engagement. read more →

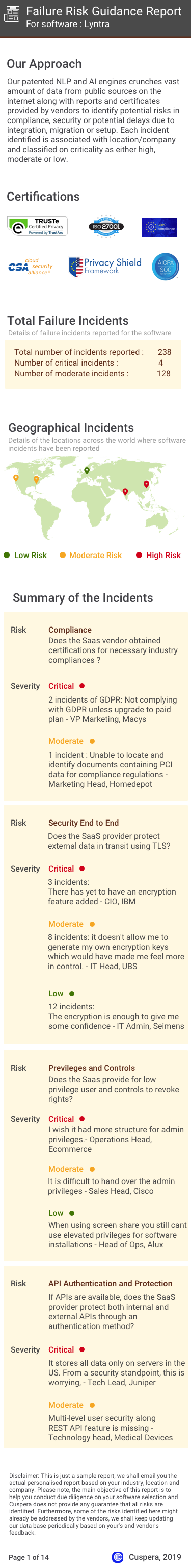

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Dynamic Yield in Action: Unique Use Cases

What solutions does Dynamic Yield provide for Engagement Management?

Why is Dynamic Yield the best choice for Merchandising?

How can Dynamic Yield optimize your Training & Onboarding Workflow?

What benefits does Dynamic Yield offer for Helpdesk Management?

What makes Dynamic Yield ideal for Segmentation And Targeting?

CredSpark in Action: Unique Use Cases

What makes CredSpark ideal for Generation Of New Leads?

How does CredSpark facilitate Advertisement?

Integrations

Few Dynamic Yield Integrations

News

Latest Dynamic Yield News

Banking’s Personalization Revolution: Data-Driven Transformation

Explore how financial institutions overcome personalization challenges due to regulatory constraints and outdated systems with experts from Openbox and Dynamic Yield by Mastercard.

Explore how financial institutions overcome personalization challenges due to regulatory constraints and outdated systems with experts from Openbox and Dynamic Yield by Mastercard.

The post Banking’s Personalization Revolution: Data-Driven Transformation appeared first on Dynamic Yield.

Latest CredSpark News

Omeda and CredSpark Deepen Partnership & Software Integration, Making Audience Engagement and 1st-Party Data Capture Faster & Easier Than Ever Before.

Omeda and CredSpark have expanded their partnership and software integration. This collaboration streamlines audience engagement and first-party data capture for clients. The enhanced integration aims to deliver significant time savings and new data opportunities for both existing and prospective users in media, publishing, and related industries.