Overview: Sage Intacct and Itemize as Revenue Management Category solutions.

Sage Intacct excels in managing diverse financial tasks, offering robust integrations, and supporting core business processes. It's well-suited for large enterprises and organizations requiring extensive customization. Itemize leans towards enhancing customer engagement with limited financial management features, appealing to smaller segments and industries focusing on marketing insights.

Sage Intacct: Sage Intacct is a leading cloud-based accounting software for various industries, offering multi-entity consolidation and real-time reporting. It integrates with other cloud services and supports strategic decision-making with industry-specific dashboards.

Itemize: Itemize is transforming financial transaction processing through its AI-powered platform. Line-Item intelligence unlocks value in Accounts Payable, Receivables, Supply Chain, and Loan Processing.

Sage Intacct and Itemize: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Sage Intacct supports sales document and workflow management, catering to organizations with complex contract and revenue management needs. read more →

Itemize emphasizes helpdesk management and competitive intelligence, helping businesses focus on marketing and international outreach. read more →

Business Goals

Businesses use Sage Intacct to scale best practices and improve sales and revenue, aligning with strategic goals of large enterprises. read more →

Itemize's primary business goal is enhancing customer relationships, which suits companies focusing on engagement and follow-up. read more →

Core Features

Sage Intacct features extensive data import/export and analytics capabilities, which are vital for rapid integration and reporting. read more →

Itemize offers AI-powered tools and integration facilities, appealing to businesses that need analytics with smaller data sets. read more →

Vendor Support

The platform offers extensive support including 24/7 options catering to complex enterprise needs with demanding operational requirements. read more →

Itemize provides basic 24/7 support but less comprehensive than Sage, targeting businesses with simpler support requirements. read more →

Segments and Industries

Sage Intacct is widely used by large enterprises and accounting firms, reflecting its fit for industries with rigorous financial requirements. read more →

Itemize is popular among educational and wholesale industries, suitable for businesses looking for targeted marketing insights. read more →

Operational Alignment

Sage Intacct integrates smoothly into large, complex operational environments, particularly for enterprises needing detailed financial oversight. read more →

Itemize fits smaller scale operations, especially for businesses focusing on marketing and customer relationship management. read more →

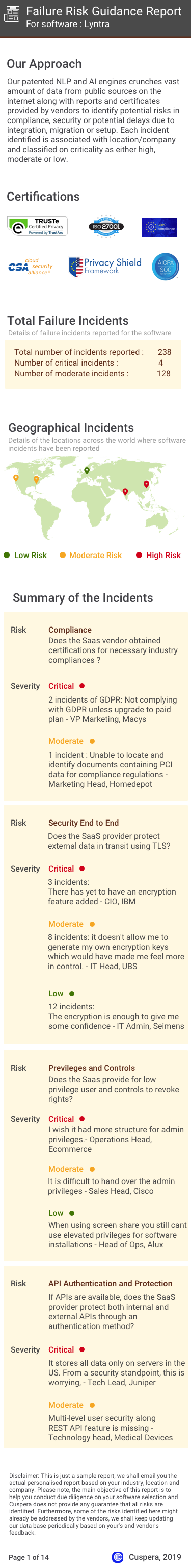

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Sage Intacct in Action: Unique Use Cases

How can Sage Intacct enhance your Workflow Management process?

What Are the key features of Sage Intacct for Revenue Cycle Management?

How can Sage Intacct enhance your Forecasting process?

How efficiently Does Sage Intacct manage your Helpdesk Management?

Itemize in Action: Unique Use Cases

How does Itemize facilitate Competitive Intelligence?

What makes Itemize ideal for Advertisement?

Alternatives

News

Latest Sage Intacct News

Sage Releases Firmware Fix

Sage released a firmware update for its Digital ENDEC model 3644, addressing an issue where alerts were incorrectly displayed in a "severe" color. The update, Rev96-1-P1, corrects this and adds support for Missing and Endangered Persons event codes. It is available for U.S. users and is recommended for installation.

Latest Itemize News

Safeguarding Financial Transactions: Leveraging AI and Itemize for Risk Mitigation

The financial industry is undergoing a transformation driven by artificial intelligence (AI), promising enhanced efficiencies, innovative solutions, and improved customer experiences. However, with these advancements come significant risks. Financial institutions must adopt a proactive approach to harness the benefits of AI while mitigating potential pitfalls. This blog explores the intersection of AI and financial risk, …

Safeguarding Financial Transactions: Leveraging AI and Itemize for Risk Mitigation Read More »

The post Safeguarding Financial Transactions: Leveraging AI and Itemize for Risk Mitigation appeared first on Itemize.