Overview: Recurly and Itemize as Revenue Management Category solutions.

Recurly and Itemize both serve the Revenue Management sector but cater to diverse needs. Recurly excels with robust subscription and billing management, appealing to enterprise and tech-focused industries. In contrast, Itemize leans towards competitive intelligence and marketing insights, suitable for financial and educational sectors. While both offer extensive integration and reporting features, Recurly provides superior customer support options and broader user segmentation.

Recurly: Recurly is the best subscription management software and recurring billing platform, compatible with leading ERP, CRM, payment gateways, fraud, and tax solutions. It simplifies subscription and billing processes.

Itemize: Itemize is transforming financial transaction processing through its AI-powered platform. Line-Item intelligence unlocks value in Accounts Payable, Receivables, Supply Chain, and Loan Processing.

Recurly and Itemize: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Recurly supports subscription management, billing, and invoicing, which fits well with tech companies managing recurring revenues. read more →

Itemize focuses on helpdesk and workflow management, addressing operational issues and enabling competitive insights. read more →

Business Goals

Recurly aims to enhance customer relationships and boost customer lifetime value, aligning with companies wanting to deepen client interactions. read more →

Itemize has less focus on relationship enhancement but provides marketing and analytics tools, ideal for businesses looking to refine competitive strategies. read more →

Core Features

Recurly boasts data integration and custom reporting, helping businesses with complex data needs streamline operations. read more →

Itemize offers a rich array of data imports and analytics, serving businesses that prioritize data-driven decision-making. read more →

Vendor Support

Recurly offers around-the-clock support with multiple channels, benefiting enterprises requiring extensive assistance. read more →

Itemize provides 24/7 support but with fewer channels, which might suit smaller teams or budgets that seek simple guidance. read more →

Segments and Industries

Recurly dominates in Internet and IT services, with a strong foothold in enterprises and mid-market sectors, emphasizing its scalability. read more →

Itemize finds its niche in education and financial services, catering to large enterprises while also reaching smaller businesses. read more →

Operational Alignment

Recurly's design is optimized for large-scale operations, aligning with technology firms managing extensive subscriptions. read more →

Itemize fits varied operational workflows, suiting diverse industries that rely on tailored marketing strategies. read more →

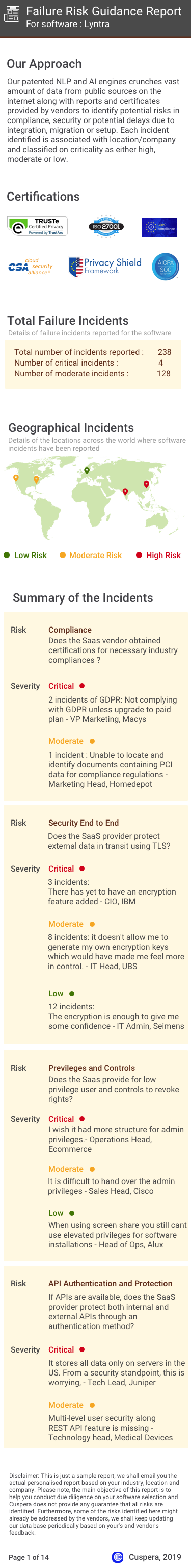

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Recurly in Action: Unique Use Cases

What solutions does Recurly provide for Subscription Management?

How can Recurly optimize your Billing And Invoice Management Workflow?

What solutions does Recurly provide for Communication Management?

How can Recurly optimize your Engagement Management Workflow?

Itemize in Action: Unique Use Cases

What makes Itemize ideal for Workflow Management?

How can Itemize enhance your Competitive Intelligence process?

How can Itemize optimize your Advertisement Workflow?

Alternatives

News

Latest Recurly News

Recurly Acquires Redfast and Prive to Ramp Up Its Commerce, Retention Tools

Recurly has acquired Redfast (now Recurly Engage) and Prive (now Recurly Commerce) to expand its subscription management platform with enhanced subscriber engagement and commerce automation. Redfast CEO Rajeev Raman joins Recurly to lead Engage, while Prives founders serve as advisors during integration.

Latest Itemize News

Safeguarding Financial Transactions: Leveraging AI and Itemize for Risk Mitigation

The financial industry is undergoing a transformation driven by artificial intelligence (AI), promising enhanced efficiencies, innovative solutions, and improved customer experiences. However, with these advancements come significant risks. Financial institutions must adopt a proactive approach to harness the benefits of AI while mitigating potential pitfalls. This blog explores the intersection of AI and financial risk, …

Safeguarding Financial Transactions: Leveraging AI and Itemize for Risk Mitigation Read More »

The post Safeguarding Financial Transactions: Leveraging AI and Itemize for Risk Mitigation appeared first on Itemize.