Overview: Vero and TransUnion TruAudience as Email Marketing Category solutions.

Vero excels in meeting the comprehensive needs of large enterprises in the Email Marketing category with its strong capabilities in communication and workflow management. It supports strategic goals such as customer relationship enhancement and increasing sales, making it popular in industries like Internet and IT. In contrast, TransUnion TruAudience caters to the engagement management needs across digital platforms, with a focus on compliance and integration. It is ideal for businesses prioritizing risk management and improving digital visibility.

Vero: Vero sends personalized mobile push notifications and emails based on user activity. Customer engagement is enhanced through tailored messaging.

TransUnion TruAudience: TransUnion-Digital-Marketing offers a platform to build predictive audiences in hours. These custom audiences improve targeting, optimize bidding, and expand scale.

Vero and TransUnion TruAudience: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Vero facilitates communication and workflow management, helping teams streamline engagement, manage tasks, and efficiently execute campaigns. read more →

TransUnion TruAudience focuses on engagement and revenue cycle management, benefiting those seeking to improve customer interactions across social platforms. read more →

Business Goals

For Vero users, the primary goals are enhancing customer relationships and increasing sales, aligning with enterprises aiming to boost revenue through improved engagement. read more →

TransUnion TruAudience aims to acquire customers and manage risks, suited for companies that prioritize strategic decisions and online presence. read more →

Core Features

Vero offers robust analytics, data handling, and strong integrations, ideal for large enterprises demanding comprehensive data and reporting. read more →

TransUnion TruAudience provides seamless compliance, analytics, and integration features, facilitating digital marketing strategies. read more →

Vendor Support

Vero provides around-the-clock support, catering to large enterprises needing consistent assistance via email and phone. read more →

TransUnion TruAudience offers 24/7 support, addressing the needs of users requiring assistance on a flexible basis. read more →

Segments and Industries

Vero is favored among large enterprises, especially within the IT and marketing sectors, where it meets complex operational needs. read more →

TransUnion TruAudience does not specify its user segments but is versatile for various industries. read more →

Operational Alignment

Vero integrates seamlessly into the workflows of large-scale operations, focusing on communication and task management. read more →

TransUnion TruAudience fits businesses looking to enhance digital engagement and manage workflows efficiently, irrespective of size. read more →

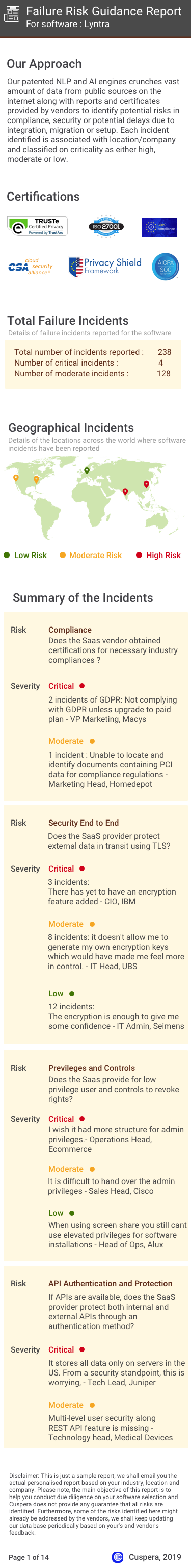

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Vero in Action: Unique Use Cases

How efficiently Does Vero manage your Workflow Management?

How can Vero enhance your Communication Management process?

What solutions does Vero provide for Campaign Management?

What solutions does Vero provide for Product Marketing?

TransUnion TruAudience in Action: Unique Use Cases

What solutions does TransUnion TruAudience provide for Engagement Management?

What Are the key features of TransUnion TruAudience for Helpdesk Management?

How can TransUnion TruAudience optimize your Revenue Cycle Management Workflow?

How does TransUnion TruAudience address your Digital Marketing Challenges?

Integrations

Few Vero Integrations

Few TransUnion TruAudience Integrations

News

Latest Vero News

Vero Technologies and Quiktrak Mark Integration Milestone with 5,000 Coordinated Audits

Vero Technologies and Quiktrak Mark Integration Milestone with 5,000 Coordinated Audits

Latest TransUnion TruAudience News

Intent IQ, TransUnion, and Involved Media Prove Performance of Au

TransUnion, Intent IQ, and Involved Media collaborated on a campaign to enhance audience engagement in cookieless environments, achieving nearly 40% more conversions and a 44% reduction in Cost-per-Lead. The partnership utilized TransUnion's audience data and Intent IQ's data enrichment to target over 150 million iOS users and 70 million desktop users, setting a new standard for audience amplification and performance.