Floify Overview

Floify enhances mortgage origination by offering a digital platform tailored for brokers, independent mortgage banks, banks, and credit unions. It simplifies the loan origination process, ensuring a smooth borrower experience. Floify's platform acts as a point-of-sale system, integrating seamlessly into existing workflows. This positions lenders to efficiently manage documents, track loan progress, and communicate with borrowers. A unique aspect of Floify is its customization capabilities, allowing lenders to adapt the platform to their specific lending practices. This flexibility supports diverse lending styles, setting Floify apart in the competitive mortgage technology landscape.

Use Cases

Customers recommend Digital Signature, Engaging And Following Up, Workflow Management, as the business use cases that they have been most satisfied with while using Floify.

Business Priorities

Acquire Customers and Improve Internal Communications are the most popular business priorities that customers and associates have achieved using Floify.

Floify Use-Cases and Business Priorities: Customer Satisfaction Data

Floify works with different mediums / channels such as Phone Calls. E-Mail. and Website.

Floify's features include Alerts: Popups & Notifications, Templates, Landing Page, etc. and Floify support capabilities include 24/7 Support, Chat Support, Phone Support, etc. also Floify analytics capabilities include Analytics, and Custom Reports.

Reviews

"...I LOVE THE FACT THAT IT GENERATE THE FOLLOW UP LETTER..." Peer review by Angela M., Loan Officer/Branch Manager, Real Estate

Floify, monday sales CRM, E-Sign, NetHunt CRM, OnePageCRM, etc., all belong to a category of solutions that help CRM. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Floify streamlines the loan origination process and enhances borrower experiences. It is the leading mortgage point-of-sale platform for brokers, IMBs, banks, and credit unions.

Popular Business Setting

for Floify

Top Industries

- Financial Services

- Real Estate

- Banking

Popular in

- Small Business

- Mid Market

- Enterprise

Floify is popular in Financial Services, Real Estate, and Banking and is widely used by Small Business, Mid Market, and Enterprise.

Floify Customer wins, Customer success stories, Case studies

How efficiently Does Floify manage your Digital Signature?

How can Floify optimize your Engaging And Following Up Workflow?

How does Floify address your Workflow Management Challenges?

How does Floify facilitate Generation Of New Leads?

What solutions does Floify provide for Helpdesk Management?

11 buyers and buying teams have used Cuspera to assess how well Floify solved their CRM needs. Cuspera uses 934 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific CRM needs.

What is Floify?

Frequently Asked Questions(FAQ)

for Floify

What is Floify?

Floify is a Mortgage Automation and Point-of-Sale Solution that helps to automate and manage all processes of loan origination. It helps mortgage professionals automate lending processes and improve communication between all stakeholders.

It provides a portal to collect and verify documents, track progress, and efficiently close borrowing pipelines, to increase the profitability of mortgage operations. It has a secure document portal, automated borrower and agent notification platform, suite of productivity integrations and so much more.

Key features include loan document management, customer database, loan processing, multi-branch support, digital signature, credit reporting, visual representation and more. It allows businesses to create customizable 1003 applications and facilitate processes by managing creditors' and borrowers' eConsent through an online portal. Floify integrates with various third-party applications such as Encompass, Calyx, Byte, LendingQB, Docusign, DropBox, Google Drive, Veri-Tax and Slack along with banks.

What is Floify used for?

What are the top features of Floify?

Who uses Floify?

What are Floify alternatives?

Where is Floify located?

Floify Competitors

Floify Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| Analytics | Read Reviews (6) |

| Custom Reports | Read Reviews (132) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| Analytics | Read Reviews (6) |

| Custom Reports | Read Reviews (132) |

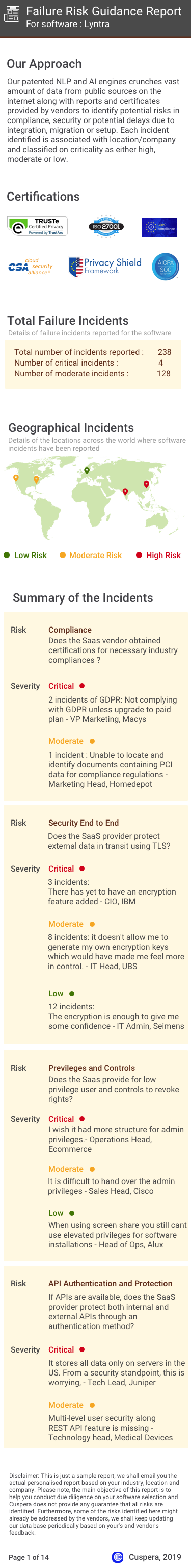

Software Failure Risk Guidance

?for Floify

Overall Risk Meter

Top Failure Risks for Floify

Floify LLC Profile

Company Name

Floify LLC

Company Website

https://floify.com/HQ Location

Boulder, Colorado US

Employees

11-50

Social

Financials

PRIVATE