Overview: Phocas and InsFocus as Business Intelligence Category solutions.

Phocas excels in providing a broad range of capabilities, especially for sales-driven industries like wholesale and manufacturing, by enhancing customer relationships and offering extensive analytics and reporting features. InsFocus Insurance BI focuses on providing niche capabilities for the insurance sector, emphasizing risk management and improved efficiency with robust analytics and seamless integration features.

Phocas: Phocas Software offers BI and FP&A tools for financial reporting, planning, budgeting, and forecasting. It helps users analyze past data, improve current operations, and plan future strategies.

InsFocus: Insfocus-Insurance-BI offers a specialized expert system for insurance professionals. Analytical insights and business intelligence are provided to enhance decision-making.

Phocas and InsFocus: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Phocas supports activities such as competitive intelligence and lead generation, making it suitable for enhancing business strategies and sales operations. read more →

InsFocus Insurance BI provides competitive intelligence and social media analytics, vital for campaign and engagement management in the insurance sector. read more →

Business Goals

Phocas aims to increase sales and revenue while enhancing customer relationships, aligning with enterprises focused on growth and market expansion. read more →

InsFocus Insurance BI aims to manage risk and improve efficiency, aligning with insurance companies seeking enhanced operational performance. read more →

Core Features

Phocas offers robust features like custom reports and data import, catering to diverse analytical and integration needs, supporting extensive data handling. read more →

InsFocus Insurance BI features analytics and custom reports, crucial for detailed data analysis and strategic insights in the insurance industry. read more →

Vendor Support

Phocas provides comprehensive vendor support options, including 24/7 assistance, addressing complex enterprise requirements. read more →

InsFocus Insurance BI offers 24/7 support, ensuring consistent availability for businesses in need of constant assistance. read more →

Segments and Industries

Phocas serves a broad range of customer segments, predominantly in wholesale and construction, supporting a wide array of industry-specific needs. read more →

InsFocus Insurance BI caters specifically to enterprises in the insurance industry, providing tailored solutions for sector-specific challenges. read more →

Operational Alignment

Phocas integrates well into the workflows of large enterprises and mid-markets, offering seamless data handling and reporting processes. read more →

InsFocus Insurance BI aligns with the insurance industry's operational needs, focusing on simplifying processes and enhancing risk management. read more →

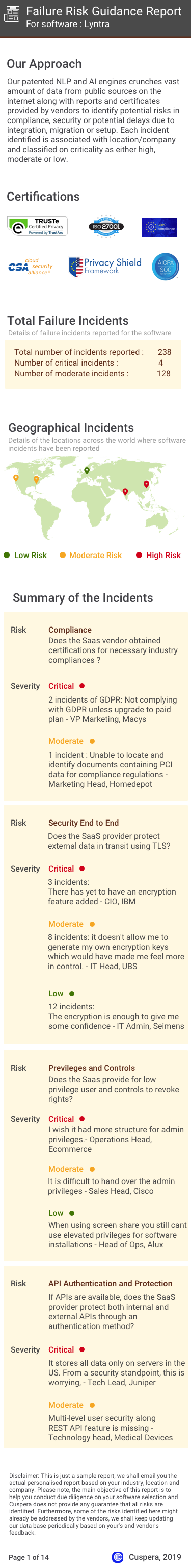

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Most deployed common Use Cases for Phocas and InsFocus

What Are the key features of Phocas and InsFocus for Competitive Intelligence?

Phocas in Action: Unique Use Cases

What makes Phocas ideal for Helpdesk Management?

How does Phocas address your Forecasting Challenges?

What Are the key features of Phocas for Collaboration?

How efficiently Does Phocas manage your Contact List Management?

Alternatives

News

Latest Phocas News

Phocas marks a decade as a Built for NetSuite (BFN) partner

Phocas Software celebrates 10 years as a NetSuite SuiteCloud Developer Network Partner, enhancing data accessibility for manufacturers, distributors, and retailers. Reports that once took days are now available in seconds, empowering users with accurate insights.

Latest InsFocus News

Fadata Working With InsFocus on Data Analytics - - Insurance Edge

Fadata is collaborating with InsFocus on data analytics to enhance insurance solutions.