News

Customer stories

CardVision Overview

Cardvision helps businesses by using data analytics to understand card portfolios and cardholder behavior. Card Expert aids in improving card portfolios for growth.

CardVision Use-Cases and Business Priorities: Customer Satisfaction Data

CardVision Customer Insights, Testimonials and Case Studies

CardVision Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| Custom Reports | Read Reviews (23) |

| Analytics | Read Reviews (9) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| Custom Reports | Read Reviews (23) |

| Analytics | Read Reviews (9) |

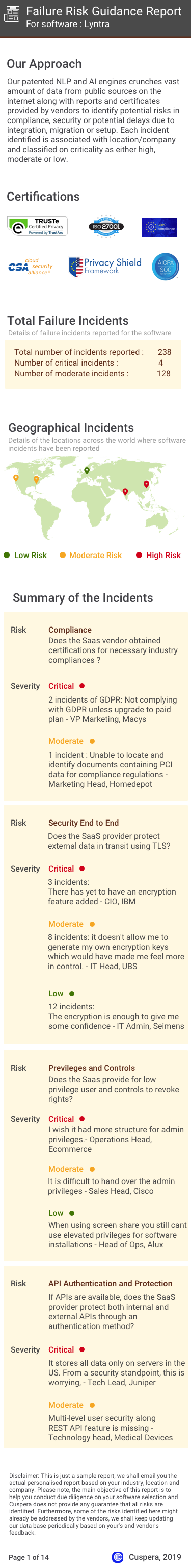

Software Failure Risk Guidance

?for CardVision

Top Failure Risks for CardVision

Fiserv, Inc. Profile

Company Name

Fiserv, Inc.

Company Website

//fiserv.com/en.htmlHQ Location

255 Fiserv Drive, Brookfield, Wisconsin 53045, US

Employees

10001+

Social

Financials

PRIVATE