Overview: Chartio and InsFocus as Business Intelligence Category solutions.

Chartio and InsFocus Insurance BI are both Business Intelligence tools, but they serve different purposes. Chartio stands out with comprehensive data handling capabilities, crucial for large enterprises in tech industries looking for enhanced analytics. InsFocus Insurance BI, though more niche, caters specifically to the insurance industry, focusing on risk management and operational efficiency. While Chartio appeals widely across industries, InsFocus offers targeted solutions ideal for enterprises in insurance.

Chartio: Chartio’s cloud-based solution enables data analysis from business applications. Their analytics platform allows everyone to explore data easily.

InsFocus: Insfocus-Insurance-BI offers a specialized expert system for insurance professionals. Analytical insights and business intelligence are provided to enhance decision-making.

Chartio and InsFocus: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Chartio facilitates competitive intelligence, social media analytics, and management. These capabilities support firms in tech-focused industries to analyze market trends and manage online presence. read more →

InsFocus Insurance BI supports competitive intelligence and segmentation. It is tailored for insurance firms needing focused insights and performance management. read more →

Business Goals

Chartio helps businesses scale best practices, acquire new customers, and boost sales, supporting enterprises in expanding market reach. read more →

InsFocus Insurance BI aids in managing risk and improving efficiency, aligning with the strategic needs of insurance firms to optimize their core processes. read more →

Core Features

Chartio’s standout features include expansive data export and custom reporting. These features cater to complex data analysis demands of large enterprises. read more →

InsFocus Insurance BI offers robust analytics and custom reporting, essential for insurance companies focused on detailed performance evaluation. read more →

Vendor Support

Chartio offers 24/7 support across various channels like chat and phone. This support facilitates seamless integration for large-scale users. read more →

InsFocus Insurance BI provides 24/7 email support, which suits enterprises in the insurance sector that prefer simple and direct vendor communication. read more →

Segments and Industries

Chartio is predominantly used by enterprises in the internet and software sectors, reflecting its adaptability across tech-focused industries. read more →

InsFocus Insurance BI is used primarily in the insurance industry, aligning with its focus on addressing specific industry challenges. read more →

Operational Alignment

Chartio integrates into the operational workflows of enterprises requiring comprehensive data solutions, supporting diverse operational environments. read more →

InsFocus Insurance BI fits specifically into the workflows of insurance firms, tailored for efficient data management and risk assessment. read more →

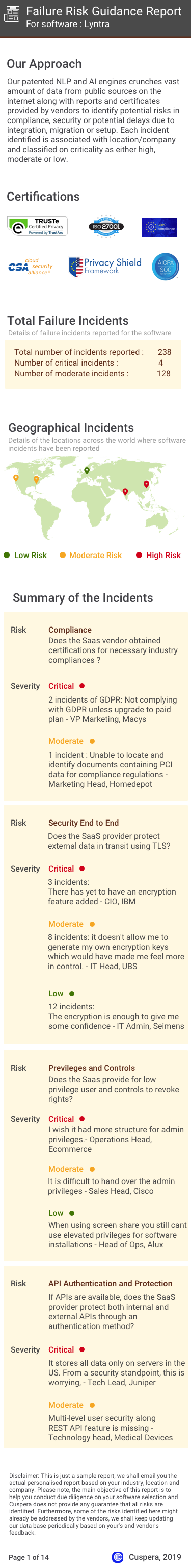

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Chartio in Action: Unique Use Cases

What benefits does Chartio offer for Competitive Intelligence?

How can Chartio enhance your Engagement Management process?

How can Chartio optimize your Products & Pricelist Management Workflow?

What benefits does Chartio offer for Workflow Management?

News

Latest InsFocus News

Fadata Working With InsFocus on Data Analytics - - Insurance Edge

Fadata is collaborating with InsFocus on data analytics to enhance insurance solutions.