Cardlytics Overview

Cardlytics leverages its card-linked offer network to drive measurable business growth for advertisers. By utilizing deterministic purchase data, Cardlytics enables precise audience targeting, converting both online and in-store transactions. This approach facilitates accurate performance measurement, allowing businesses to understand customer spending patterns down to the penny. Financial institutions and publishers benefit from best-in-class offers, enhancing customer engagement and loyalty. The platform's ability to turn data into actionable insights supports revenue growth, making it a valuable tool for brands seeking to optimize their advertising strategies.

Use Cases

Customers recommend Loyalty Management, Advertisement, Engagement Management, as the business use cases that they have been most satisfied with while using Cardlytics.

Business Priorities

Acquire Customers and Enhance Customer Relationships are the most popular business priorities that customers and associates have achieved using Cardlytics.

Cardlytics Use-Cases and Business Priorities: Customer Satisfaction Data

Cardlytics's features include Rewards, Gamification, Dashboard, etc. and Cardlytics support capabilities include 24/7 Support, AI Powered, Email Support, etc. also Cardlytics analytics capabilities include Analytics, and Custom Reports.

Reviews

"...Cardlytics Measurement uses purchase data to help you understand the true sales impact, both in-store and online, of your marketing campaigns...." Peer review

Cardlytics, Jeeng, TripleLift, Adnow, ContentFleet, etc., all belong to a category of solutions that help Native Advertising. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Cardlytics uses Purchase Intelligence to help marketers identify opportunities and deliver relevant ads to real people. Results are then precisely measured to ensure effectiveness.

Cardlytics Customer wins, Customer success stories, Case studies

What makes Cardlytics ideal for Loyalty Management?

Why is Cardlytics the best choice for Advertisement?

How does Cardlytics address your Engagement Management Challenges?

How does Cardlytics facilitate Campaign Management?

39 buyers and buying teams have used Cuspera to assess how well Cardlytics solved their Native Advertising needs. Cuspera uses 204 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Native Advertising needs.

About Cardlytics

Cardlytics Competitors

Cardlytics Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (1) |

| Analytics | Read Reviews (28) |

| Custom Reports | Read Reviews (20) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (1) |

| Analytics | Read Reviews (28) |

| Custom Reports | Read Reviews (20) |

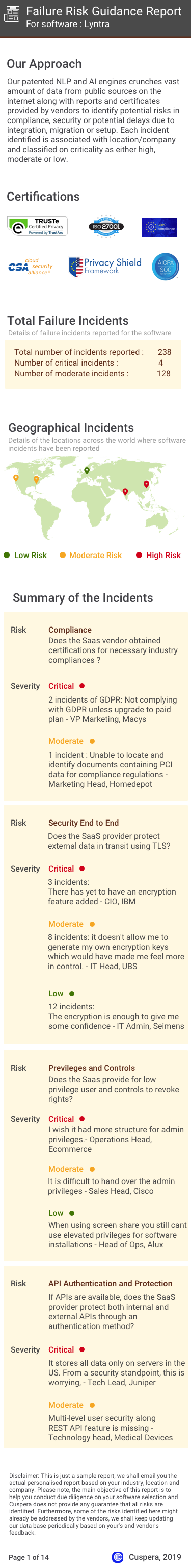

Software Failure Risk Guidance

?for Cardlytics

Overall Risk Meter

Top Failure Risks for Cardlytics

Cardlytics, Inc. Profile

Company Name

Cardlytics, Inc.

Company Website

https://www.cardlytics.com/HQ Location

Atlanta, GA

Employees

251-500

Social

Financials

SERIES G