Temenos Transact Overview

Temenos-transact is the most successful and widely used digital core-banking solution globally. Temenos Core Banking software streamlines and enhances banking operations.

Use Cases

Customers recommend Engagement Management, Lead Qualification: Technographic, Product Marketing, as the business use cases that they have been most satisfied with while using Temenos Transact.

Business Priorities

Acquire Customers and Increase Sales & Revenue are the most popular business priorities that customers and associates have achieved using Temenos Transact.

Temenos Transact Use-Cases and Business Priorities: Customer Satisfaction Data

Temenos Transact works with different mediums / channels such as Omnichannel.

Reviews

"...Good user interaction, easy administration and flexible licensing methods...." Peer review by Alexandru B., CISO, Banking

Popular Business Setting

for Temenos Transact

Top Industries

- Banking

- Financial Services

- Accounting

Popular in

- Enterprise

- Small Business

Temenos Transact is popular in Banking, Financial Services, and Accounting and is widely used by Enterprise, and Small Business,

Temenos Transact Customer wins, Customer success stories, Case studies

How efficiently Does Temenos Transact manage your Engagement Management?

How can Temenos Transact optimize your Lead Qualification: Technographic Workflow?

How does Temenos Transact address your Collaboration Challenges?

17 buyers and buying teams have used Cuspera to assess how well Temenos Transact solved their business needs. Cuspera uses 250 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific business needs.

Temenos Transact Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (8) |

| Custom Reports | Read Reviews (33) |

| Analytics | Read Reviews (20) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (8) |

| Custom Reports | Read Reviews (33) |

| Analytics | Read Reviews (20) |

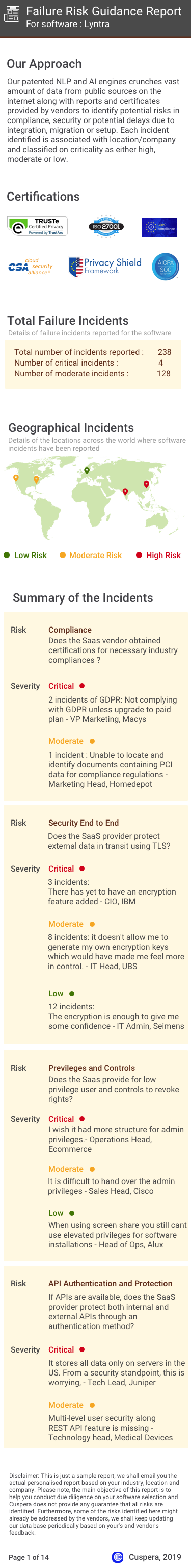

Software Failure Risk Guidance

?for Temenos Transact

Overall Risk Meter

Top Failure Risks for Temenos Transact

Temenos AG Profile

Company Name

Temenos AG

Company Website

https://www.temenos.com/HQ Location

5th Floor, 71 Fenchurch Street, London, EC3M 4TD, GB

Employees

5001-10000

Social

Financials

IPO