TRUE QC Platform Overview

TRUE enhances the lending process by delivering precise data that fuels automation, streamlining the entire lending lifecycle. This results in reduced costs and risks while enhancing the customer experience. In practical terms, TRUE provides instant borrower intelligence, enabling lenders to make informed decisions rapidly. The platform's capabilities allow for processing times as short as three to five minutes, which is crucial for teams aiming to improve efficiency and responsiveness in mortgage operations. By integrating AI-driven insights, TRUE supports lenders in navigating the evolving landscape of mortgage modernization, ensuring they remain competitive in a rapidly changing market.

Use Cases

Customers recommend Knowledge Management, Workflow Management, Digital Signature, as the business use cases that they have been most satisfied with while using TRUE QC Platform.

Business Priorities

Improve ROI is the most popular business priority that customers and associates have achieved using TRUE QC Platform.

TRUE QC Platform Use-Cases and Business Priorities: Customer Satisfaction Data

True-qc-platform offers configurable AI solutions for automating the mortgage lending lifecycle. TRUE Lending Intelligence enhances efficiency and accuracy in lending processes.

TRUE QC Platform Customer wins, Customer success stories, Case studies

How does TRUE QC Platform facilitate Workflow Management?

TRUE QC Platform Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (10) |

| Custom Reports | Read Reviews (7) |

| Analytics | Read Reviews (1) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (10) |

| Custom Reports | Read Reviews (7) |

| Analytics | Read Reviews (1) |

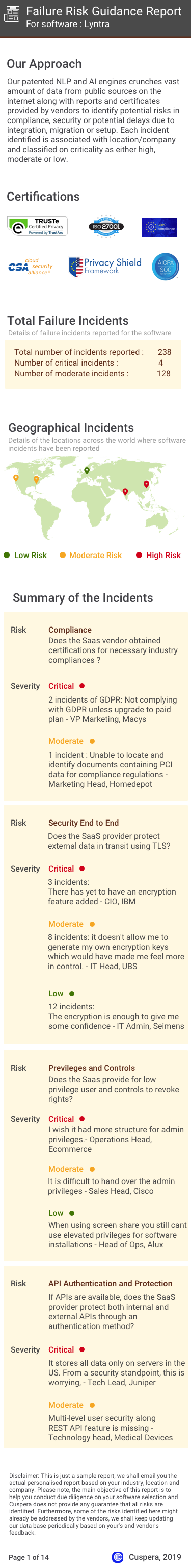

Software Failure Risk Guidance

?for TRUE QC Platform

Top Failure Risks for TRUE QC Platform

True AI Limited Profile

Company Name

True AI Limited

Company Website

https://true.ai/HQ Location

New York, USA

Employees

11-50

Social

Financials

PRIVATE