Overview: Qlikview and InsFocus as Business Intelligence Category solutions.

Qlikview and InsFocus Insurance BI address distinct aspects of Business Intelligence. Qlikview suits a broad array of industries with its customizable features like analytics and data management, making it a versatile tool for companies pursuing efficiency and growth. In contrast, InsFocus Insurance BI targets the insurance sector, offering solutions tailored to risk management and efficiency enhancement. Both products provide vendor support, but Qlikview offers a wider range of options, appealing to larger, more diverse enterprises.

Qlikview: QlikView has been replaced with Qlik Cloud Analytics for a cloud-based SaaS deployment. Qlik Sense serves as the on-premises solution.

InsFocus: Insfocus-Insurance-BI offers a specialized expert system for insurance professionals. Analytical insights and business intelligence are provided to enhance decision-making.

Qlikview and InsFocus: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

Qlikview offers robust social media analytics and management, communication and customer feedback management, which helps businesses stay competitive and responsive. read more →

InsFocus Insurance BI focuses on competitive intelligence and social media analytics, essential for informed decision-making and strategic positioning in insurance. read more →

Business Goals

Qlikview helps increase sales and revenue, improve efficiency, and acquire customers, facilitating growth and operational excellence. read more →

InsFocus Insurance BI assists in managing risk and improving efficiency, aligning with the strategic needs of insurance providers. read more →

Core Features

Standout features of Qlikview include comprehensive analytics, custom reports, and integrated data management tools, aiding diverse user needs. read more →

InsFocus Insurance BI provides tailored analytics and risk management features, catering specifically to the insurance market. read more →

Vendor Support

Qlikview offers extensive vendor support options, including 24/7 support, chat, email, and phone services, suitable for complex enterprise needs. read more →

InsFocus Insurance BI provides basic 24/7 and email support, reflecting its focus on the specific insurance industry. read more →

Segments and Industries

Qlikview serves a diverse range of industries, prominently IT, with segments ranging from small businesses to large enterprises. read more →

InsFocus Insurance BI specifically targets the insurance industry, catering to enterprise-level clients. read more →

Operational Alignment

Qlikview aligns well with varied operational workflows, thanks to its scalable features suitable for enterprises of all sizes. read more →

InsFocus Insurance BI fits insurance sector workflows, designed for enterprises seeking improved efficiency and risk management capabilities. read more →

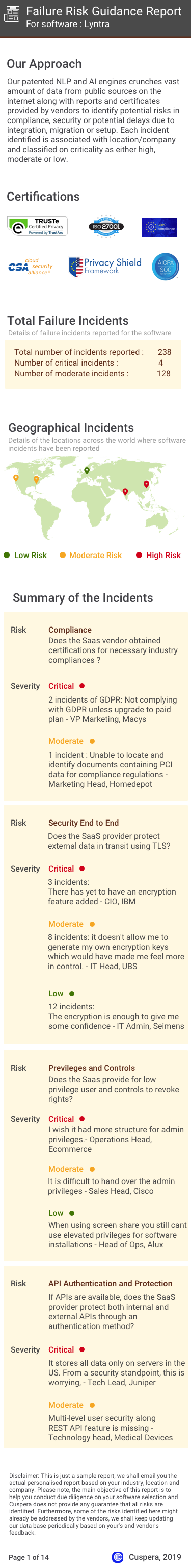

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

Qlikview in Action: Unique Use Cases

Why is Qlikview the best choice for Communication Management?

What makes Qlikview ideal for Customer Feedback Management?

How efficiently Does Qlikview manage your Funnel Analysis?

InsFocus in Action: Unique Use Cases

How efficiently Does InsFocus manage your Competitive Intelligence?

News

Latest Qlikview News

Qlik Open Lakehouse Now Generally Available, Giving Enterprises Rapid, AI-Ready Data ...

Qlik Open Lakehouse Now Generally Available, Giving Enterprises Rapid, AI-Ready Data ...

Latest InsFocus News

Fadata Working With InsFocus on Data Analytics - - Insurance Edge

Fadata is collaborating with InsFocus on data analytics to enhance insurance solutions.