Overview: InsFocus and Phrazor as Business Intelligence Category solutions.

InsFocus Insurance BI and Phrazor both cater to the Business Intelligence sector, but they serve distinct needs and audiences. InsFocus Insurance BI is designed primarily for the insurance industry, offering a focused approach to risk management and efficiency improvement. In contrast, Phrazor offers broad competitive intelligence capabilities and significant AI-powered features, appealing to financial services and banking sectors with goals centered around ROI and sales growth. Both solutions provide comprehensive support, but their user segments, industries served, and core strengths highlight differences in operational alignment and strategic focus.

InsFocus: Insfocus-Insurance-BI offers a specialized expert system for insurance professionals. Analytical insights and business intelligence are provided to enhance decision-making.

Phrazor: Phrazor, an AI-powered platform, simplifies business reports with insightful narratives. Reporting automation and business intelligence are enhanced using natural language generation.

InsFocus and Phrazor: Best Use cases based on the customer satisfaction data

Key Capabilities Supported

InsFocus Insurance BI offers capabilities such as competitive intelligence and social media analytics, which assist insurance experts. read more →

Phrazor provides extensive capabilities in competitive intelligence and social media management, catering to broader markets. read more →

Business Goals

InsFocus Insurance BI helps manage risk and scale practices efficiently, aligning with insurance industry needs. read more →

Phrazor focuses on improving ROI and increasing sales, enhancing customer relationships and market share. read more →

Core Features

InsFocus Insurance BI stands out with custom reports and data analytics, crucial for insurance data handling. read more →

Phrazor shines with AI-powered analytics and custom reporting, making it suitable for insights-driven decisions. read more →

Vendor Support

InsFocus Insurance BI offers 24/7 support, vital for enterprise clients needing prompt assistance. read more →

Phrazor provides robust support options including training and 24/7 assistance, suitable for diverse user needs. read more →

Segments and Industries

InsFocus Insurance BI is favored by enterprises within the insurance sector, underlining its specialization. read more →

Phrazor serves mid-market clients across financial services and banking, highlighting its broad financial industry appeal. read more →

Operational Alignment

InsFocus Insurance BI fits seamlessly into insurance workflows, focusing on data integration and compliance. read more →

Phrazor aligns with complex data environments, offering scalable solutions ideal for markets like financial services. read more →

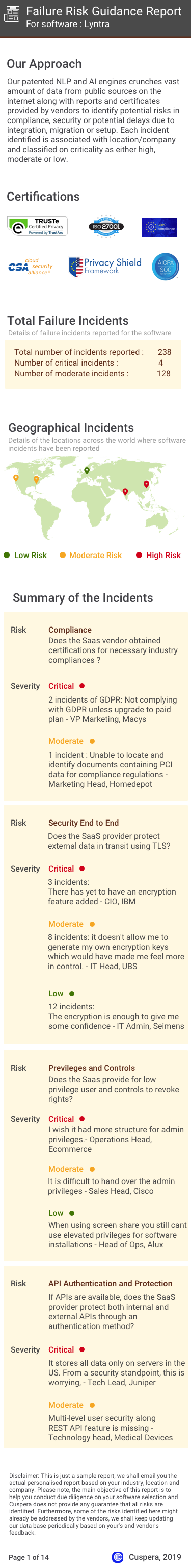

Failure Risk Guidance?

Compliance Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Security & Privacy Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Integration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

Migration Risk

{{{rsh_C_1}}}

{{{rsh_C_1}}}

IT and Other Capabilities

- Low

- Medium

- High

Data

Support

Others

InsFocus in Action: Unique Use Cases

What benefits does InsFocus offer for Competitive Intelligence?

Phrazor in Action: Unique Use Cases

Why is Phrazor the best choice for Performance Management?

What benefits does Phrazor offer for Engagement Management?

How does Phrazor address your Generation Of New Leads Challenges?

News

Latest InsFocus News

Fadata Working With InsFocus on Data Analytics - - Insurance Edge

Fadata is collaborating with InsFocus on data analytics to enhance insurance solutions.